CPF Contribution Table 2025: The CPF Contribution Table 2025 has introduced new contribution rates, wage ceilings, and other updates to ensure the Central Provident Fund (CPF) continues to meet the needs of Singapore’s workforce. As a mandatory savings scheme, the CPF plays a critical role in helping citizens and permanent residents (PRs) plan for their future by providing financial support for retirement, healthcare, housing, and other essentials.

This article explores the latest changes to CPF contributions, the implications for employees and employers, and how you can make the most of your CPF savings in 2025.

Overview of CPF Contribution Table 2025

| Aspect | Details |

| Employee Contribution | Up to 20% of monthly wages, depending on age. |

| Employer Contribution | Up to 17% of monthly wages, depending on age. |

| Ordinary Wage Ceiling | $6,800 per month. |

| Additional Wage Ceiling | Applies to non-regular income such as bonuses and is capped annually. |

| Permanent Residents (PRs) | Contribution rates vary during the first two years of employment. |

| Key Uses | Retirement, healthcare, housing, and investment purposes. |

What is the CPF?

The Central Provident Fund (CPF) is a comprehensive savings system that ensures financial security for Singaporeans and permanent residents. Established to address essential life needs, the CPF system collects contributions from both employers and employees. These contributions are then allocated to different accounts based on their intended use:

- Ordinary Account (OA): Primarily used for housing, education, and approved investments.

- Special Account (SA): Reserved for retirement savings with higher interest rates.

- Medisave Account (MA): Dedicated to healthcare expenses, including medical treatments and insurance premiums.

- Retirement Account (RA): Created at age 55 by combining OA and SA savings to support retirement payouts.

The CPF is not just about retirement—it’s a versatile tool that also supports housing ownership, healthcare, and investment, making it a cornerstone of financial planning in Singapore.

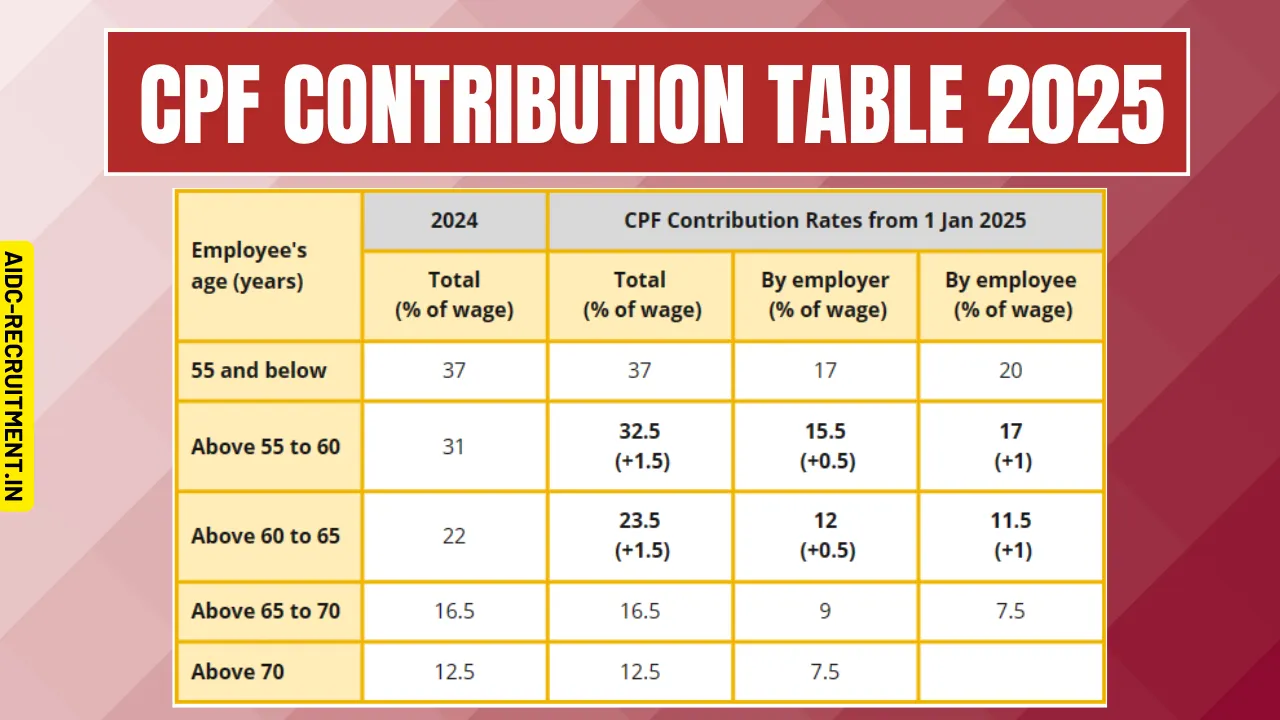

CPF Contribution Rates for 2025

The CPF contribution rates for employees and employers depend on the employee’s age. Here is the breakdown of rates effective 1 January 2025:

| Age Group | Employer Contribution | Employee Contribution | Total Contribution Rate |

| Up to 55 years | 17% | 20% | 37% |

| 55 to 60 years | 15% | 16% | 31% |

| 60 to 65 years | 11.5% | 10.5% | 22% |

| 65 to 70 years | 9% | 7.5% | 16.5% |

| Above 70 years | 7.5% | 5% | 12.5% |

Contribution Rates for Permanent Residents (PRs)

Permanent residents (PRs) contribute at different rates during their first two years of employment in Singapore:

- First Year: Employer contributions range from 4% to 9%, while employees contribute 5% to 15%.

- Second Year: Employer contributions increase to 6% to 15%, and employee rates rise to 7.5% to 12.5%.

- After the second year, PRs follow the same contribution rates as citizens.

CPF Wage Ceilings

CPF contributions are subject to two main wage ceilings to ensure fairness and sustainability.

1. Ordinary Wage Ceiling

The ordinary wage ceiling for 2025 is set at $6,800 per month. Contributions are only required for wages up to this amount. Salaries exceeding this ceiling are not subject to CPF deductions.

2. Additional Wage Ceiling

The additional wage ceiling applies to non-regular income such as bonuses. This annual cap ensures that contributions for additional wages do not exceed a specified limit. For instance, if an employee earns $6,800 monthly and receives a $50,000 bonus, CPF contributions for the bonus would be capped at $20,400.

These ceilings help balance the financial burden of contributions between employees and employers while ensuring equitable savings for all workers.

Benefits of the CPF System

The CPF is more than a savings account—it’s a comprehensive financial tool that provides several benefits to contributors.

1. Competitive Interest Rates

CPF accounts offer higher interest rates than traditional savings accounts:

- Ordinary Account (OA): 3.5% per annum.

- Special Account (SA) and Medisave Account (MA): 5% per annum.

These rates enable contributors to grow their savings steadily over time with minimal risk.

2. Shared Contributions

Employers are required to contribute a portion of employees’ CPF savings, reducing the financial strain on workers and ensuring a shared commitment to financial security.

3. Flexibility of Funds

- Housing: CPF savings can be used to finance housing loans, making homeownership more accessible.

- Healthcare: Medisave funds can cover medical expenses and insurance premiums.

- Retirement: Special Account savings ensure steady payouts during retirement.

4. Retirement Payouts

Upon reaching the retirement age of 63, individuals can withdraw from their CPF accounts, providing financial stability during their non-working years.

How Employers Submit CPF Contributions

Employers must ensure timely CPF contributions for their employees. The process includes:

- Preparing Contribution Data

Employers need to prepare a CPF PAL file, a .txt file containing the details of employee contributions. - Submission via CPF Portal

Employers can use SingPass or CorpPass to access the CPF portal and submit contributions online. - Payment Methods

CPF payments can be made through:

- Direct Debit.

- eNETS.

- Standing Instructions.

- Cheques.

- AXS Stations.

Deadlines

Contributions are due by the last day of each month, but payments made by the 14th of the following month are still considered on time.

Maximizing Your CPF Savings

To make the most of your CPF contributions in 2025, consider the following tips:

1. Track Your Contributions

Monitor your CPF account regularly to ensure that contributions are accurate and up-to-date.

2. Leverage Housing Benefits

Use your Ordinary Account savings to service housing loans, reducing the burden of high property costs.

3. Plan for Retirement

Maximize your Special Account savings to benefit from higher interest rates and ensure a steady income in retirement.

4. Manage Healthcare Costs

Tap into your Medisave Account to cover medical expenses and insurance premiums, minimizing out-of-pocket costs.

5. Explore CPF Investment Schemes

Consider approved investment opportunities through the CPF Investment Scheme (CPFIS) to grow your savings further.

Frequently Asked Questions (FAQs)

What happens if my salary exceeds the CPF ordinary wage ceiling?

CPF contributions are only required for wages up to the $6,800 ceiling. Income beyond this amount is not subject to CPF deductions.

Are CPF contributions the same for PRs and citizens?

PRs contribute at reduced rates during their first two years of employment. After that, they follow the same rates as citizens.

How can I withdraw CPF funds?

You can withdraw funds from your Special Account at age 63. Withdrawals from the Ordinary Account and Medisave Account are subject to specific conditions, such as housing or healthcare needs.

Are CPF contributions tax-deductible?

Yes, CPF contributions are tax-deductible for employers, and employees’ contributions reduce their taxable income.

What happens if employers miss the CPF payment deadline?

Late payments may incur penalties. Employers are advised to ensure timely contributions to avoid fines.

Final Thoughts

The CPF Contribution Table 2025 introduces important updates that impact employees and employers alike. With revised contribution rates, wage ceilings, and tailored rates for PRs, the CPF system remains a critical component of Singapore’s financial framework.

Understanding these changes is key to maximizing your CPF benefits, whether for retirement, healthcare, or housing. Employers must also stay compliant with the updated regulations to support their workforce effectively.

For more details, visit the CPF portal or consult a financial advisor. Share this article to help others stay informed about the CPF Contribution Table 2025 and its implications for their financial future.

Read Also