CPF Contribution Table 2025: The CPF Contribution Table 2025 introduces important updates to Singapore’s Central Provident Fund (CPF) system, ensuring that employees and employers remain informed about new contribution rates, wage ceilings, and regulations. The CPF is a crucial component of Singapore’s social security framework, designed to support citizens and permanent residents in retirement planning, healthcare expenses, and housing needs.

This article breaks down the latest CPF contribution rates, discusses the benefits of the system, and highlights the key changes for 2025 that employees and employers need to know.

Overview of CPF Contribution Table 2025

| Aspect | Details |

| Maximum Contribution Rate | 37% combined for employees and employers for workers under 55 years. |

| Ordinary Wage Ceiling | $6,800 per month. |

| Additional Wage Ceiling | Capped annually, includes bonuses and non-regular income. |

| PR Contribution Rates | Lower rates during the first two years of employment. |

| Primary CPF Accounts | Ordinary, Special, Medisave, and Retirement accounts. |

Understanding the CPF System

The Central Provident Fund (CPF) is a compulsory savings scheme that helps Singaporeans and permanent residents (PRs) build a secure financial future. Contributions are made by both employees and employers, with the funds allocated to specific accounts that address key life needs:

- Ordinary Account (OA): Used for housing, education, and investments.

- Special Account (SA): Dedicated to retirement savings, offering higher interest rates.

- Medisave Account (MA): Reserved for healthcare expenses and insurance premiums.

- Retirement Account (RA): Created at age 55 by combining balances from the OA and SA to provide retirement payouts.

These accounts work together to ensure financial stability for individuals across different stages of life.

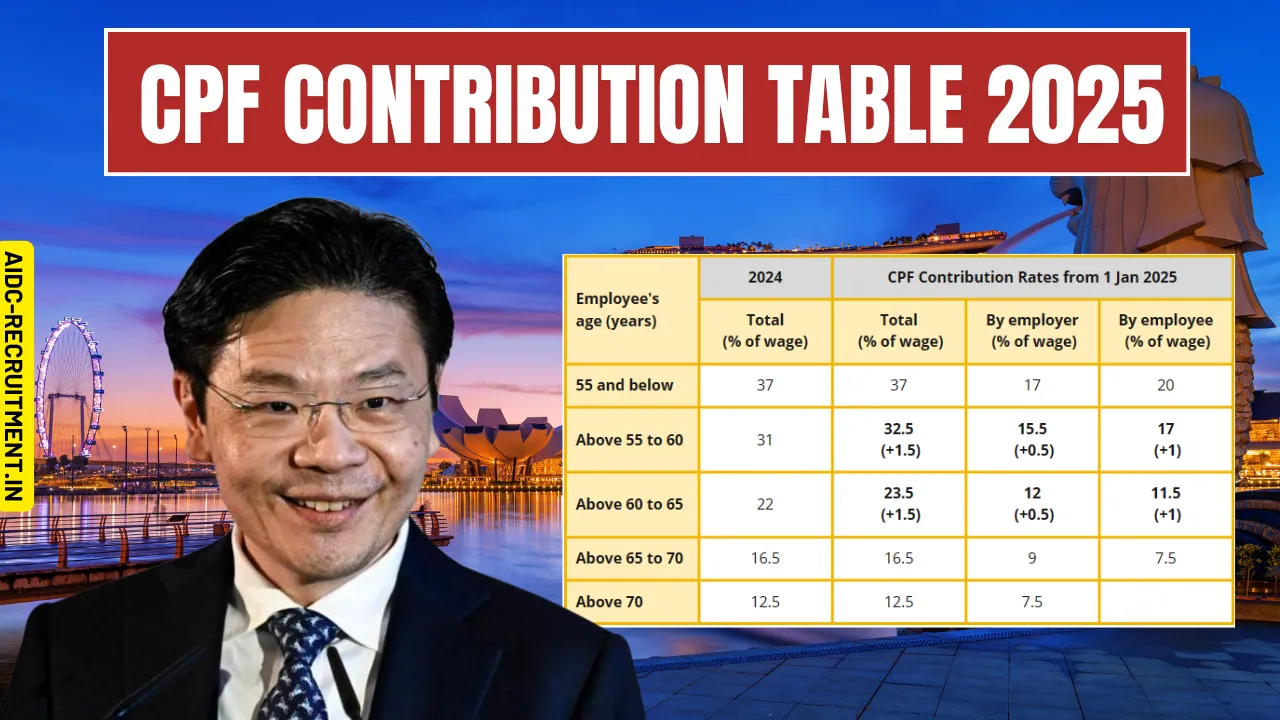

CPF Contribution Rates for 2025

CPF contribution rates vary based on the employee’s age, reflecting the government’s emphasis on retirement savings during peak earning years.

| Age Group | Employer Contribution | Employee Contribution | Total Contribution Rate |

| Up to 55 years | 17% | 20% | 37% |

| 55 to 60 years | 15% | 16% | 31% |

| 60 to 65 years | 11.5% | 10.5% | 22% |

| 65 to 70 years | 9% | 7.5% | 16.5% |

| Above 70 years | 7.5% | 5% | 12.5% |

These rates ensure that individuals save adequately for retirement while recognizing the reduced earning capacity of older workers.

Contribution Rates for Permanent Residents (PRs)

Permanent residents (PRs) have different contribution rates during their initial two years of employment in Singapore:

- First Year: Employer contributions range from 4% to 9%, while employees contribute 5% to 15%.

- Second Year: Employer contributions increase to 6% to 15%, and employees contribute 7.5% to 12.5%.

- Third Year and Beyond: PRs contribute at the same rates as Singaporean citizens.

This phased approach helps PRs transition into Singapore’s CPF system gradually.

CPF Wage Ceilings

CPF contributions are capped by wage ceilings to ensure fairness and sustainability.

1. Ordinary Wage Ceiling

The ordinary wage ceiling for 2025 is set at $6,800 per month. Contributions are required only for salaries up to this limit, and any income above this ceiling is not subject to CPF deductions.

2. Additional Wage Ceiling

The additional wage ceiling applies to bonuses and other non-regular income, with annual caps to limit contributions. For example:

- If an employee earns $6,800 monthly and receives a $50,000 bonus, CPF contributions for the bonus are capped at $20,400 annually.

These ceilings help balance contributions while ensuring individuals save adequately for future needs.

Benefits of CPF Contributions

The CPF system provides several benefits, making it a cornerstone of financial planning in Singapore.

1. Higher Interest Rates

CPF accounts offer competitive interest rates compared to traditional savings accounts:

- Ordinary Account (OA): 3.5% per annum.

- Special Account (SA) and Medisave Account (MA): 5% per annum.

2. Shared Responsibility

Employers contribute a significant portion of an employee’s CPF savings, ensuring that individuals are not solely responsible for their financial security.

3. Flexible Usage

CPF savings can be used for various purposes:

- Housing: Financing home purchases and paying off housing loans.

- Healthcare: Covering medical bills and insurance through Medisave.

- Retirement: Providing monthly payouts during retirement through the Retirement Account.

4. Retirement Security

At age 63, individuals can begin withdrawing from their CPF savings, ensuring a steady income in their retirement years.

How Employers Submit CPF Contributions

Employers play a crucial role in the CPF system, ensuring that contributions are made accurately and on time.

- Preparing Contribution Data

Employers compile employee details into a CPF PAL file, which contains the necessary data for submission. - Submitting via CPF Portal

Employers can use SingPass or CorpPass to access the CPF portal and upload the CPF PAL file. - Choosing Payment Methods

CPF contributions can be paid through:

- Direct Debit.

- eNETS.

- Standing Instructions.

- Cheques.

- AXS Stations.

Deadlines

- Contributions are due by the last day of the month.

- Payments made by the 14th of the following month are considered on time.

Maximizing Your CPF Savings

To make the most of CPF contributions, individuals and employers can adopt the following strategies:

1. Monitor Contributions

Review your CPF statements regularly to ensure that contributions are accurate and up-to-date.

2. Leverage Housing Benefits

Use your Ordinary Account savings to finance home purchases or service housing loans.

3. Plan for Retirement

Maximize contributions to your Special Account, which offers higher interest rates and ensures greater financial security during retirement.

4. Utilize Medisave for Healthcare

Tap into your Medisave savings to cover medical expenses, reducing out-of-pocket costs for treatments and insurance premiums.

5. Invest Strategically

Explore the CPF Investment Scheme (CPFIS) to grow your savings through approved investments such as bonds, stocks, and unit trusts.

Frequently Asked Questions (FAQs)

What happens if my salary exceeds the CPF ordinary wage ceiling?

Contributions are capped at $6,800 per month for ordinary wages. Income beyond this ceiling is not subject to CPF deductions.

When can I withdraw my CPF savings?

You can start withdrawing funds from your Special Account at age 63. Withdrawals from other accounts are subject to specific conditions.

Are CPF contributions tax-deductible?

Yes, CPF contributions reduce taxable income for employees, and employers can claim deductions for their share of contributions.

What happens if employers miss the CPF payment deadline?

Late payments may incur penalties, so employers should ensure timely submission to avoid fines.

Final Thoughts

The CPF Contribution Table 2025 brings important updates that impact employees, employers, and permanent residents in Singapore. With revised contribution rates, wage ceilings, and enhanced flexibility, the CPF system remains a vital part of Singapore’s financial ecosystem.

Understanding these changes can help individuals maximize their savings while ensuring compliance with regulations. Employers also benefit from staying updated to manage contributions accurately and support their workforce.

Share this article to help others stay informed about the CPF Contribution Table 2025, and explore how the CPF can support your financial goals.