CPF Contribution Table 2025: The Central Provident Fund (CPF) is a cornerstone of Singapore’s social security system, designed to help citizens and permanent residents save for essential needs such as retirement, healthcare, and housing. Updated annually to adapt to changing economic circumstances, the CPF Contribution Table 2025 introduces revised contribution rates and wage ceilings, ensuring employees and employers are aligned with the nation’s financial security goals.

This article explores the CPF Contribution Table 2025, including updated contribution rates, age-specific variations, and key benefits for CPF contributors. Whether you’re a Singaporean employee, employer, or permanent resident (PR), understanding these updates is essential for financial planning.

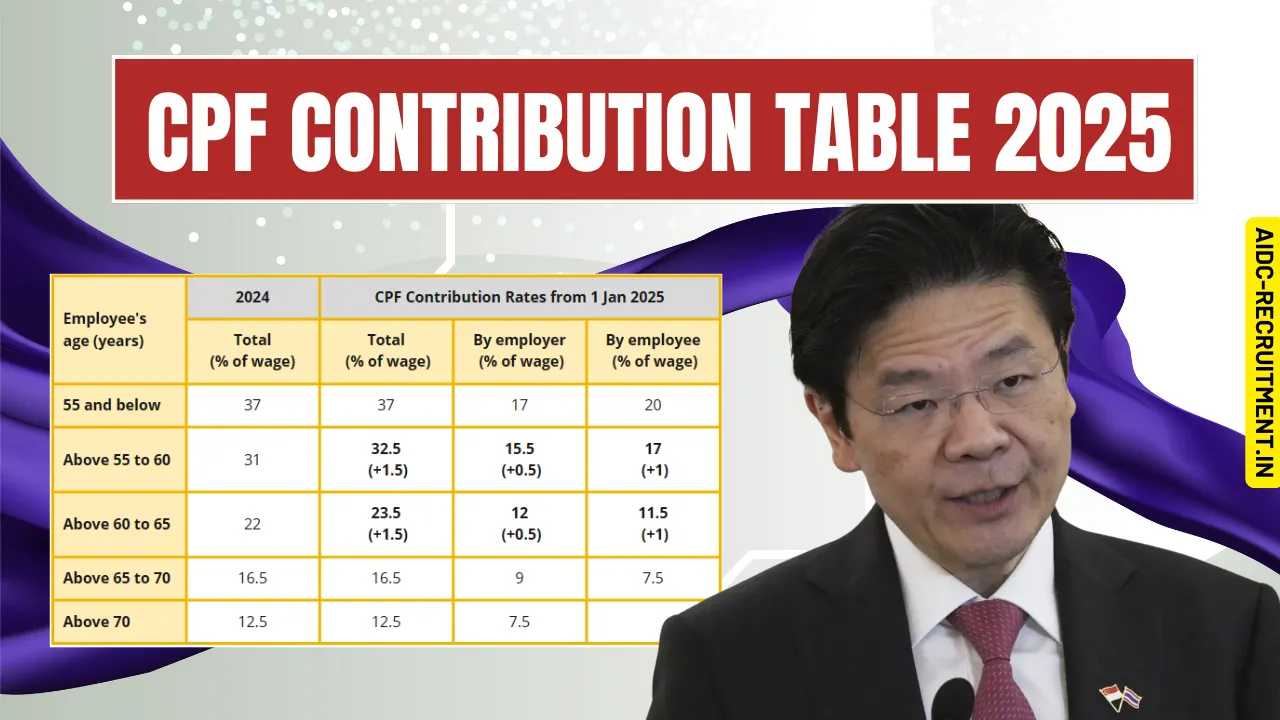

Overview Table: CPF Contribution Table 2025

| Category | Details |

| Purpose | Retirement, healthcare, and housing savings |

| Ordinary Wage Ceiling | $6,800 per month |

| Contribution Rates (Up to 55 years) | Employer: 17%, Employee: 20% (Total: 37%) |

| Permanent Residents (PRs) | Lower contribution rates for the first two years |

| Effective Date | January 1, 2025 |

| Payment Deadline | Last day of the month, with a grace period until the 14th of the following month |

What Is the CPF and Why Is It Important?

The Central Provident Fund (CPF) is a mandatory savings scheme aimed at securing financial stability for Singaporeans and permanent residents. Both employees and employers contribute a percentage of the employee’s salary to CPF accounts, which are allocated for different purposes:

- Ordinary Account (OA): Used for housing, education, and approved investments.

- Special Account (SA): Focused on long-term retirement savings.

- Medisave Account (MA): Reserved for medical expenses and health insurance.

- Retirement Account (RA): Created when an individual turns 55, merging savings from the OA and SA to fund retirement payouts.

These accounts provide contributors with a comprehensive safety net, offering higher interest rates compared to traditional savings accounts and ensuring sufficient funds for major life expenses.

CPF Contribution Rates for 2025

The CPF Contribution Table 2025 outlines the percentage of salary that employees and employers must contribute, based on the employee’s age. These rates ensure that younger employees save more aggressively, while older workers contribute less to reflect their shorter time horizon before retirement.

Contribution Rates (Singapore Citizens and PRs Beyond Two Years)

| Age Group | Employer Contribution | Employee Contribution | Total Contribution |

| Up to 55 years | 17% | 20% | 37% |

| 55 to 60 years | 15% | 16% | 31% |

| 60 to 65 years | 11.5% | 10.5% | 22% |

| 65 to 70 years | 9% | 7.5% | 16.5% |

| Above 70 years | 7.5% | 5% | 12.5% |

Contribution Rates for Permanent Residents (PRs)

PRs enjoy lower CPF contribution rates during their initial two years of employment to ease their financial transition.

- First Year: Employers contribute 4% to 9%, while employees contribute 5% to 15%.

- Second Year: Employers contribute 6% to 15%, while employees contribute 7.5% to 12.5%.

- From the third year onward, PRs contribute at the same rates as Singaporean citizens.

Singapore CPF Limits 2025

Ordinary Wage Ceiling

The ordinary wage ceiling sets the maximum amount of monthly salary subject to CPF contributions. For 2025, this ceiling is $6,800. Any earnings above this threshold are exempt from CPF contributions.

For example, if an employee earns $7,500 per month, CPF contributions are only calculated on $6,800, while the remaining $700 is excluded.

Additional Wage Ceiling

The additional wage ceiling applies to bonuses and other non-monthly payments. It is calculated annually and ensures that contributions are capped to prevent over-contribution. For example, if an employee earning $6,800 per month receives a $50,000 bonus, CPF contributions would only apply to an additional wage cap of $20,400, rather than the entire bonus amount.

CPF Benefits in 2025

The CPF system is designed to deliver long-term financial benefits, ensuring contributors are well-prepared for retirement and other significant life expenses. Key advantages include:

1. Higher Interest Rates

CPF accounts offer competitive interest rates, with the Ordinary Account earning 3.5%, and the Special and Medisave Accounts earning 5%. These rates surpass those of standard savings accounts, allowing contributors to grow their wealth more effectively.

2. Employer Contributions

Employers are legally required to contribute a portion of their employees’ salaries to CPF accounts, boosting the total amount saved without additional effort from the employee.

3. Flexible Withdrawals

- Contributors can withdraw from their Special Account upon reaching the minimum retirement age of 63.

- Funds in the Ordinary Account and Medisave Account can only be used for housing and medical costs, respectively, ensuring savings are directed toward essential needs.

CPF Contribution Deadlines

Employers must submit CPF contributions by the last day of the month. However, a grace period extends until the 14th of the following month. Payments can be made through various channels, including:

- CPF e-Submit Portal (accessible via SingPass or CorpPass)

- Direct debit or eNETS

- Cheques or AXS Stations

Timely submission is crucial to avoid penalties, and employers are advised to verify the accuracy of their contribution data through the CPF PAL file, a text document detailing contribution details.

Practical Insights for Employers and Employees

For Employers

- Ensure Compliance: Use the CPF e-Submit portal to make timely and accurate contributions.

- Classify Wages Correctly: Differentiate between ordinary and additional wages to avoid over-contribution.

- Leverage CPF Tools: Use CPF calculators available on the official website to estimate contributions.

For Employees

- Understand Your CPF Accounts: Familiarize yourself with how your contributions are allocated across the Ordinary, Special, and Medisave Accounts.

- Plan for the Future: Maximize your contributions early in your career to benefit from compound interest over time.

- Check Your Statements: Regularly review your CPF statements to ensure contributions are accurately reflected.

CPF in 2025: What’s New?

Updated Contribution Rates

The new rates for 2025 reflect the government’s effort to balance savings with affordability for older workers, whose contribution rates decline with age.

Contribution for Permanent Residents

The CPF system offers reduced rates for PRs during their initial years, helping them transition into Singapore’s social security framework.

Digital Convenience

The CPF e-Submit portal streamlines contribution submission for employers, while employees can monitor their accounts via the CPF Mobile App or My CPF Online Services.

Conclusion

The CPF Contribution Table 2025 continues to play a vital role in securing the financial future of Singaporean citizens and permanent residents. By maintaining competitive interest rates, enforcing mandatory contributions, and adjusting limits and rates annually, the CPF system remains one of the most robust social security programs in the world.

Whether you’re an employee looking to maximize your savings, an employer ensuring compliance, or a permanent resident transitioning into the CPF system, staying informed about these updates is key to making the most of this comprehensive scheme.

For more information, visit the official CPF website at www.cpf.gov.sg.

FAQs

What is the CPF Contribution Table?

The CPF Contribution Table outlines the rates at which employees and employers contribute to the Central Provident Fund based on the employee’s age.

What is the CPF ordinary wage ceiling for 2025?

The ordinary wage ceiling for 2025 is $6,800 per month.

How do CPF rates differ for permanent residents?

Permanent residents contribute at lower rates during their first two years of employment, gradually aligning with citizen rates by the third year.

What are CPF contributions used for?

CPF contributions are allocated to the Ordinary Account, Special Account, Medisave Account, and later the Retirement Account, covering expenses such as housing, healthcare, and retirement.

How can I check my CPF contributions?

Employees can check their contributions through the CPF Mobile App or My CPF Online Services.